Table of Contents

Getting Started

Welcome to the Estimator:Introduction to the Asset Allocation Suite:

Conventions in the Estimator:

Running an Estimator Problem:

Instances:

Sample Cases:

NFA Ribbon:

Preferences:

Worksheets

Introduction to the Worksheets:Asset Returns Worksheet:

Historical Worksheet:

Forecasts Worksheet:

Components Worksheet:

Effects Worksheet:

Results Worksheet:

Charts Worksheet:

Estimation Inputs

Return Series:Importing Returns from Outside Sources:

Importing CSV Returns:

Bloomberg:

Financial Modeling Prep (FMP):

Loading:

Benchmarks Return Series:

Assets Wizard:

Forecasts:

Forecast Contrasts:

Market Portfolio:

Period:

Series Adjustment Value:

Risk Scaling Factor:

Asset Groups:

Adjusting Data

Historic Data Adjustment:Missing Data Algorithm:

Forecast Data Adjustment:

Estimator Output

Moving to the Optimizer:Reporting:

Saving Files:

Copying and Pasting:

Multiple and Partial Correlations:

Charts

Asset Correlations:Asset Ranges:

Assets Risk and Return:

Growth of Asset(s):

Histogram:

Historical Returns:

Rolling Correlations:

Troubleshooting

Error Handling:Troubleshooting Tools:

Debugging Log:

Known Issues:

Add-In Not Loaded:

Welcome to the Estimator

The Estimator is the best way to create well-formed and consistent optimization inputs for the New Frontier Optimizer that properly combine multiple sources of information. The Estimator is comprised of historical data importing tools, a robust missing data algorithm, noise reduction with various shrinkage estimator, and a flexible system for combining the cleaned and adjusted historical inputs with exogenous views.

In addition to this help manual, New Frontier has a recorded training presentation available in our training library. Contact your relationship manager for more information.

Introductory Topics:

-

The Asset Allocation System

-

Estimator worksheets

-

Preferences

-

The NFA ribbon

-

Instances of Excel

-

Display Conventions

-

Running an estimation problem

-

Sample cases

Introduction to the Asset Allocation Suite

The three modules of the Asset Allocation System facilitate the construction of realistic, effectively diversified portfolios with well-managed risk. The software provides a complete system for making asset allocation decisions.

-

The Estimator (Data Management Module) provides many advanced statistical methods for enhancing your risk and return estimates.

-

The Optimizer (Portfolio Optimization Module) computes the Michaud Resampled Efficient Frontier™ and provides the tools to customize the optimization to your investment philosophy (constraint options, long-short, active weight, etc.).

-

-

It also contains the Michaud-Esch rebalance test, which determines whether or not a significant difference exists between the selected portfolio on the efficient frontier and the current holdings relative to likely performance. This need-to-trade test prevents ineffective and costly trades while enhancing investment value.

-

The Trade Advisor offers a probability based stopping rule for how to trade.

-

-

LifeCycle (Portfolio Analysis and Financial Planning Module) helps select the appropriate portfolio from the efficient frontier for the specific investment program.

For more information pertaining to Michaud optimization, the rebalance test, Trade Advisor, or LifeCycle's calculation methods, talk to your relationship manager or view the Optimizer and LifeCycle help manuals.

Conventions in the Estimator

Background color indicates the purpose of individual cells within the Estimator. White cells can be changed. Cells shaded a light yellow contain calculated information or information that cannot be changed manually. For example, since the Historical Worksheet picks up the Asset Names and Descriptions from the Asset Returns Worksheet, those columns are in light yellow on the Historical Worksheet.

Numbers appear in blue, black, and red. Protected, light yellow cells, contain black numbers. White, editable cells contain blue numbers. Red numbers indicate negative values. Red "N/A" indicates missing data. Light blue on the Asset Returns Worksheet indicates that a particular asset is not included in the current investment universe or is only included as a benchmark return series. Similarly, light blue contrasts are currently inactive; while bold contrasts are active.

Running an Estimator Problem

Running an estimation problem in the Estimator involves the following basic steps:

-

Prepare, load, or import a return series file.

-

Set a benchmark return series (optional).

-

Load a market portfolio (required for some estimators).

-

Select any assets that you wish to exclude from the estimation problem.

-

Set the time period by entering date parameters.

-

Choose Historic Data Adjustment options.

-

Enter forecasts (optional).

-

Enter forecast contrasts (optional).

-

Choose Forecast Data Adjustment options.

-

Click the Run Estimator button to apply the selected statistical methods.

-

Click the Run Bayes button if you have entered forecasts that you wish to apply.

-

Review results and charts.

-

Prepare reports (optional).

-

Save and import the results to the Optimizer.

Instances

Multiple Instances of Excel

Opening the Estimator through the Start Menu starts an instance of Excel, accesses Estimator, and loads the default case. Double clicking on a saved Estimator file (*.nfei) or return series (*.nfrs) similarly opens an instance of Excel, accesses Estimator, and loads your saved file. If you perform both of these actions, or repeat these actions, two instances of Excel with Estimator will be open. Opening separate instances of Excel means that closing one instance will not close the others, that you can run two instance of Estimator simultaneously, and that you cannot use New Frontier’s copy and paste tools between the two. The same advantages and limitations apply to Optimizer and LifeCycle instances operating within separate instances of Excel.

One Instance of Excel

To open multiple instances of LifeCycle, Optimizer, or Estimator within the same instance of Excel, use the launch tool. With only one instance of Excel open, New Frontier copy and paste works. However, only one application can run at a time.

|

|

From Estimator |

From Optimizer |

From LifeCycle |

|

Launch Estimator |

Copies current Estimator case into a new Estimator instance |

Launches Estimator with the default case |

Launches Estimator with the default case |

|

Launch Optimizer |

Copies Estimator data into a new Optimizer instance |

Copies current Optimizer case into a new Optimizer instance |

Launches Optimizer with the default case |

|

Launch LifeCycle |

Launches LifeCycle with the default case

|

There are three ways to launch. Each copies the Optimizer data (frontier and portfolios) into LifeCycle. The LifeCycle case depends on the option chosen:

|

Copies the entire LifeCycle information file except for the efficient frontier |

|

New |

New Estimator copies the current data into a new Estimator. |

Opens a blank, eight asset Optimizer case |

Opens a blank LifeCycle case |

Sample Cases

New Frontier provides some sample cases for your use in the samples directory. The default location for the samples directory is C:/Program Files/NewFrontier/8.0/samples. The Estimator can open Estimator cases (*.nfei) and return series (*.nfrs).

Michaud 1998 book

The Michaud 1998 book case consists of data used by Richard Michaud when he prepared Efficient Asset Management. The default inputs and results that populate the Optimizer when it is first opened come from this case. The data consists of six country equity indices and two bond indices: Canada, France, Germany, Japan, United Kingdom, United States, a U.S. bond index and a Eurobond index. The non-U.S. equity indices are all MSCI data and the U.S. equity index is the S&P 500. The dataset is meant to illustrate a reasonable global asset allocation but is not for investment purposes.

Michaud 2008 paper

The Michaud 2008 case offers the data used by Richard Michaud and Robert Michaud in "Estimation Error and Portfolio Optimization" (Journal Of Investment Management, Q1 2008). Following Jobson and Korkie (1981), the optimizations are illustrated based on the risk and returns of twenty U.S. stocks randomly chosen from 100 largest capitalization stocks in the S&P 500 index with continuous monthly returns from January 1997 through December 2006. The list of stocks, their annualized average returns, standard deviations and correlations over the period and further details are given in the appendix to the paper.

Vanguard Data

New Frontier includes data for several index funds provided by Vanguard with the Asset Allocation System. Because Vanguard uses a passive, full-replication approach to managing their index funds, the funds may be expected to serve as good proxies for the underlying indices. The equity funds track their CRSP, FTSE, and MSCI index counterparts. The fixed income index funds track the appropriate Bloomberg Barclays Capital indices.

The four Vanguard cases are named according to the frequency of the data provided: annual, monthly, quarterly, and weekly. This leads to slightly different correlations and therefore slightly different results. In addition, the weekly case lacks inflation adjustment since the CPI isn't available on a weekly basis.

These cases also contain sample contrasts to explore.

-

The Market Forecast contrast predicts an 8% total return for the market with a 10% standard deviation (confidence level). In this example, market capitalizations are used to predict each asset’s contribution to the mean return. A 60% equity, 40% bond market is assumed. For example, Europe represents a large portion of the global market, and so its contribution to the mean is expected to be greater than an equity that represents a smaller portion of the market, such as emerging markets. In this case, the forecast contrast column sums to 100%, so the capitalization weighted sum of all asset returns is expected to be approximately 8%.

-

The Equity Premium contrast demonstrates a case where a 6% premium is expected for equities over the return of fixed income assets. This contrast is set up such that the average of all equities is equal to 6% above the average of all fixed income assets. A 10% standard deviation of the mean forecast may be given as an example. The positive coefficients in this column sum to 100%. Since there are seven equal-weighted equities, give each one a coefficient of +100% / 7 = +14.3%. Similarly, since the negative fixed-income weights sum to -100%, give each of the five fixed-income assets coefficients of -100% / 5 = -20%. The return of assets with a positive coefficient will have a mean return of 6% above the mean return of the assets with negative coefficient, with some variability guided by standard deviation of the forecast.

-

The Small to Large US forecast contrast is a simple example where US Small Cap stocks are predicted to outperform US Large Cap assets by 1%. Small Growth and Small Value are each assigned coefficients of 50%. Large Cap Growth and Large Cap Value have coefficients of -50%. The mean return of the Small Cap equities is predicted to be 1% greater than the mean return of the Large Cap equities, with some variability for standard deviation. To activate this contrast, New Frontier suggests a standard deviation of around 5%.

The following funds have been included in the investment universe:

-

CPI (seasonally adjusted, as reported by the Bureau of Labor Statistics)

-

Vanguard Short-Term Bond Index

-

Vanguard Intermediate-Term Bond Index

-

Vanguard Long-Term Bond Index

-

Vanguard Inflation-Protected Securities Index

-

Vanguard High-Yield Corporate Index

-

Vanguard REIT Index

-

Vanguard European Stock Index

-

Vanguard Pacific Stock Index

-

Vanguard Emerging Markets Index

-

Vanguard Growth Index

-

Vanguard Value Index

-

Vanguard Small-Cap Growth Index

-

Vanguard Small-Cap Value Index

NFA Ribbon

-

About (NFA Icon) accesses the Application Information Window which provides version information.

-

Preferences provides access to the Preferences Window.

-

Update License offers a shortcut to the Key Updater.

File Section

-

Undo reverts the Estimator state to the last saved state. The full state of the Estimator is stored in a temporary file whenever you load, import, or run. Undo loads that saved file, which includes all inputs, options, and settings. Additional Undo or Redo commands will load the previous or subsequent saved state.

-

Redo reverses an Undo

-

New Estimator opens a new Estimator session with the same data as the current case. New Return Series opens the New Return Series Wizard and clears the current case. See Instances for more information.

-

Load loads information into the Estimator from a file.

-

Import Return Series allows importing return series in the CSV file format.

-

Import returns from Yahoo!/BLS imports return data from the sources indicated on the Asset Returns Worksheet, replacing the current data. If BLS data is not available, this option shows as Import returns from Yahoo!

-

Update returns from Yahoo!/BLS imports return data from the sources indicated on the Asset Returns Worksheet, filling in missing data as possible. If BLS data is not available, this option shows as Import returns from Yahoo!

-

Update returns since last update from Yahoo!/BLS imports return data from the sources indicated on the Asset Returns Worksheet, filling in periods only at the end of the return series. If BLS data is not available, this option shows as Import returns from Yahoo!

-

-

Save As saves information from the Estimator in the appropriate NFA file format.

-

Export Return Series causes the Estimator to save either the benchmark return series or all of the asset return series as a CSV file.

-

Run Section

-

Run Estimator converts the historic asset return series into return, standard deviation, and correlation amounts appropriate for optimization, using the Historic Data Adjustment parameters identified on the Historical Worksheet.

-

Run Bayes applies the forecasts to the estimation problem according to the parameters identified on the Forecasts Worksheet. Run Estimator before you run Bayes in order to ensure that the forecasts are added to the correct historical results.

-

Assets accesses the Assets Wizard, which permits customized sorts as well as exclusion/reinclusion of assets.

-

Validate/Resize Return Series checks and adjusts your return series when rows and columns are added or deleted.

Edit Section

-

Copy and Paste copy entire Estimator cases from Estimator session to Estimator session.

-

Edit Contrasts accesses the Contrasts Wizard.

The Estimation Options and Series Adjustment Sections are for historic data adjustment.

Workbook Section

-

The Display Menu shows and hides elements of an Estimator case that are not always used. You can access the Info Worksheet, enable the Components and Effects Worksheets, expand or contract the worksheets by hiding or revealing asset descriptions and asset groups, enable risk scaling factors, and enable forecast contrasts.

-

Launch other NFA applications. See Instances for more information.

Report accesses the Report Designer.

Help opens this help manual, which you have evidently figured out already.

Preferences

The Preferences Window permits you to adjust the settings for your applications. All preferences carry over to all of New Frontier's applications. So, the default seed selected in the Estimator also applies to the Optimizer, etc. Click the Preferences Button from the ribbon. The Preferences Window appears. Choose one of the panes by selecting the appropriate option in the tree to the left.

General Pane

-

Checking the Warn Before Attempting to Save as Excel Documents Box causes a confirmation dialog to appear whenever you attempt to save the case in Excel format rather than New Frontier format. Since Excel format does not save everything, the default settings activate this warning.

-

Checking the Hide Excel Formula Bar Box causes the Estimator to not show the row that normally appears directly below the ribbon.

-

Cases to Load on Startup: Set the case to load when each module of the Asset Allocation System opens.

Bloomberg Pane

Once Bloomberg account information is entered here, the Estimator can import data from Bloomberg. This requires an Estimator case with Bloomberg global ids entered as the ticker, a valid Bloomberg account, and an internet connection.

Misc Data Sources Pane (FMP)

The Estimator can import FMP returns once the FMP API key has been entered here. Remember to set the ticker source to FMP for each ticker in the Asset Returns Worksheet.

Debug Pane

The Debug Pane permits the user to enable debugging. Debugging should only be enabled when a specific problem has been identified, as it creates logs for each action that save to the specified folders.

Reset Pane

The Reset Pane provides the option to return the preferences to the defaults selected by New Frontier. Invoking this option will carry over to your preferences in all modules of the Asset Allocation System.

Introduction to the Worksheets

The Estimator opens with five visible worksheets for inputs and results:

-

The Assets Returns Worksheet is for working with return series.

-

The Historical Worksheet manages the historic side of the estimation problem and for initial review of the results.

-

The Forecasts Worksheet manages the forecast side of the estimation problem.

-

The Results Worksheet displays the historic, forecast, and resulting risk and return estimates for review and comparison.

-

The Charts Worksheet displays the available charts.

-

The Info Worksheet indicates the selected preferences and offers a place to make notes.

Asset Returns Worksheet

The Asset Returns Worksheet displays the return series for all of the assets included in the investment universe. This worksheet permits you to load, enter, or import return series data and adjust it in preparation for running the Estimator. All checkmarked asset return series will be included in the output return, standard deviation, and correlation estimates. The return series name can be entered in the Return Series Name Field. The benchmark return series, selected in the drop down menu in the ribbon appears in light blue in the leftmost asset column.

Exclude/include an asset from the estimation by removing the checkmark above the asset return series column.

-

Unchecked assets remain in memory and save with the case, but will not be included in the Estimator's calculations.

-

This duplicates the functionality of the checkmarks on the Optimizer's Asset Selector.

-

Excluded assets are not affected by importing or updating returns from online sources.

-

If you do exclude/include an asset's return series, it may be necessary to change the market portfolio weights.

Relevant Topics:

-

NFA ribbon - Options and commands that appear on the ribbon.

-

Loading - Populating the Returns Worksheet by loading return series by loading from a previously saved file or from online sources.

-

Return Series - The Asset Returns Worksheet (described on this page).

-

Benchmark Return Series - Selection or derivation of the benchmark return series.

-

Missing Data Algorithm - The process that the Estimator uses form estimates in the presence of incomplete return series.

-

Period - Date limits for the estimation window of historical data.

-

Asset Selector - Asset sorting and a second method of inclusion/exclusion.

Historical Worksheet

The Historical Worksheet manages the analysis of the historical return series.

Relevant Topics:

-

Running an Estimation Problem - Typical Workflow for the Estimator

-

Historic Data Adjustment - Settings and Adjustments for the Historic Data analysis

-

Asset Groups - Groupings, e. g. Asset Classes, which persist in the Optimizer

-

Period - Date limits for the historical data

-

Market Portfolio - A weighting for the assets which serves several purposes through the optimization process

-

New Frontier ribbon - A detailed description of the commands in the Estimator/Optimizer/LifeCycle

Forecasts Worksheet

Use the Forecasts Worksheet add information to the analysis that is not in the historical data.

Relevant Topics:

-

Running an Estimation Problem - Typical Workflow for the Estimator

-

Forecast Data Adjustment - The options for forecast estimation.

-

Forecasts - Single-asset exogenous information

-

Forecast Contrasts - Multi-asset exogenous information (They are only visible when toggled through the Display Menu.)

-

NFA ribbon - The options and commands that appear in the ribbon.

Components Worksheet

The Components and Effects Worksheets provide diagnostics to understand the complete effects of both single-asset forecasts and Contrast Forecasts on the Result Means of all assets in the case.

As a set of single-asset forecasts and contrast forecasts develops, each new forecast or contrast tends to have rippling effects across the entire set of assets, often unintentionally and unpredictably. The Components and Effects worksheets are diagnostic tools designed to assess the impact of each individual single-asset forecast or contrast across all the assets, so that the impacts of changes can be better understood and unpredictable movements in the result estimates can be managed by adjusting their principal causes.

Both worksheets have important information that can be useful in diagnosing problems with a set of Bayes priors. The Components worksheet mainly deals with the impact of changes to the mean of a forecast, and the Effects worksheet shows the impact across all of the assets of including each forecast versus not including it, as a generalization of the “forecast effect” row, which shows only the effect of the forecast on its own value.

Before Running Bayes on a new case, or in a case saved in a previous version of the Estimator, the tables may be populated with N/A. Numerical values will appear after Running Bayes, since the calculation of these tables depend on the interaction of the Bayes calculations.

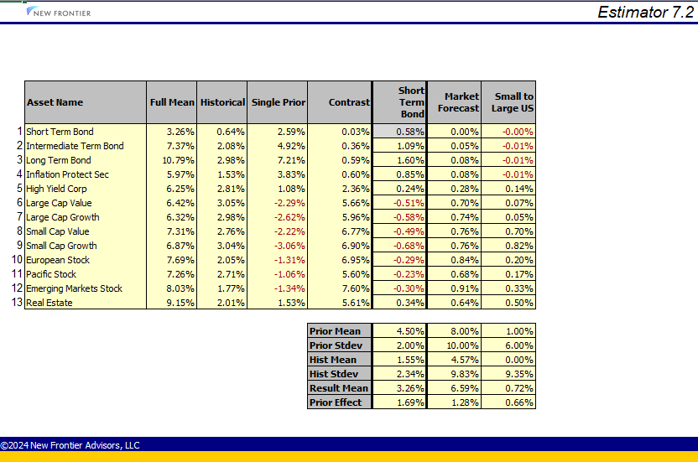

Components Worksheet

The Components Worksheet breaks out the full list of Bayes priors, starting first with the Full Mean, which is the Result Mean after the Bayes procedure, and matches the “Result Mean” on various other worksheets. Next are three columns showing the contributions of Historical, Single Prior, and Contrast to the Full Mean. The sum of these three columns are exactly equal to the full mean column. Next are a group of columns corresponding to each single-asset forecast as well as each Contrast Forecasts. These columns have been scaled by dividing by their Forecast means (in percent), so that the columns, when multiplied by their forecast means, add up to the category total. This scaling means that each column shows the impact of raising its forecast mean by 1%. This can be very useful for discovering hidden impacts on other assets or finding the source(s) of unexpected result means after running Bayes.

The Mathematics

The components analysis is derived by separating the formulas for the result mean into components corresponding to the respective parts of the whole, which sum to attain the result mean.

Result Mean = Inv(Whist + WPrior + WContrast) * (Whist * Mhist + WPrior * Mprior + WContrast * MContrast), where

Whist = Inv(CovHist), and CovHist and Mhist are the Historical Covariance Matrix and Mean Vector outputs from the Missing Data Algorithm;

WPrior = Inv(CovPrior) on the rows and colums with single-asset priors, zero otherwise; and CovPrior and MPrior are the square diagonal Matrix of Prior Variances and the Vector of Prior Means;

WContrast = ContrastMatrix’ * Inv(CovContrast) * ContrastMatrix, ContrastMatrix is the aggregate matrix of contrast coefficients, and CovContrast and MContrast are the diagonal Matrix of Contrast Variances and the Vector of Contrast Means.

Let Winv = Inv(Whist + WPrior + WContrast), then we have

Result Mean = Winv * Whist * Mhist + Winv * WPrior * Mprior + Winv * Wcontrast * MContrast.

The last line shows the decomposition of the result mean into three components (separated by the plus signs) corresponding Historical Data, Single-asset Priors, and Contrasts.

These terms can be further broken down by isolating each element of the final Mean vector corresponding to each single-asset forecast or Contrast, thus producing the unscaled components shown on the charts. The scaled components are calculated by dividing each component by its corresponding prior mean in percent, to obtain that element’s contribution to the result mean of each asset in the case when raising the prior mean by 1%.

Example:

In the above example, we have one single-asset Forecast, on Short Term Bonds with Mean 4.5% and Standard Deviation of 2%, added on the Forecasts Worksheet, as well as the two Contrast Forecasts in the sample case. The single asset forecast has the effect of raising the result mean by 0.58% for its own asset (Short Term Bonds), by raising the Forecast Mean by 1%. This value is highlighted in gray in the middle section of the chart, surrounded by heavy cell borders. Perhaps surprisingly, raising the forecast mean by 1% also has the effect, for example, of raising the result estimate for long bonds by 1.60%, and reducing the result estimate for Small Cap Growth by -0.68%. This type of example illustrates how useful this information can be in diagnosing unexpected outcomes in result means.

Similarly, we can see the impact of the two Contrast Forecasts on the case. Raising the Market Forecast Contrast Mean by 1% would cause all of the result means to increase, but some more than others. The Short Term Bond forecast is the least affected with almost no change, but the Emerging Markets Stock Forecast is raised by 0.91%. The Small to Large US Contrast Forecast has ripple effects outside of the assets in its contrast coefficients - raising its Contrast Forecast Mean by 1% will, for example, raise the Result Mean for Real Estate by 0.50%.

Whereas the Components Worksheet shows the impact of adjusting the Forecast Mean for any forecast, the Effects Worksheet shows the impact of including or excluding the entire forecast.

Effects Worksheet

As a set of single-asset forecasts and contrast forecasts develops, each new forecast or contrast tends to have ripple effects across the entire set of assets, sometimes unpredictably so. The Components and Effects worksheets are diagnostic tools designed to assess the impact of each individual single-asset forecast or contrast, so that the impacts of changes can be better understood and unpredictable movements in the result estimates can be managed by adjusting their principal causes.

Both worksheets have important information that can be useful in diagnosing problems with a set of Bayes priors. The Components worksheet mainly deals with the impact of changes to the mean of a forecast, and the Effects worksheet shows the impact across all of the assets of including each forecast versus not including it, as a generalization of the “forecast effect” row, which shows only the effect of the forecast on its own value.

Before Running Bayes on a new case, or in a case saved in a previous version of the Estimator, the tables may be populated with N/A. Numerical values will appear after Running Bayes, since the calculation of these tables depend on the interaction of the Bayes calculations.

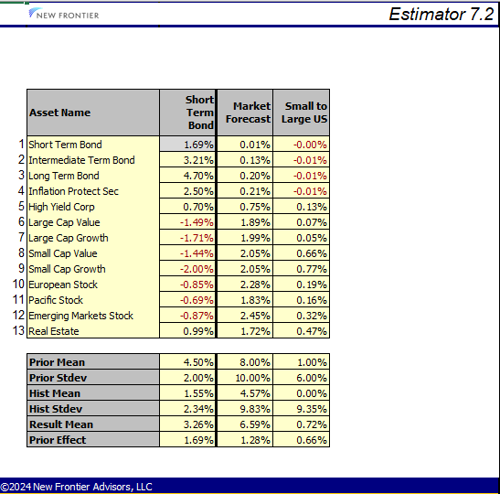

The Effects worksheet shows the impact of each forecast on the case, i. e. it is the result mean of the case minus the result mean of a case without that forecast.

Example:

In the illustrated example, a single-asset Forecast has been added for Short Term Bonds with a Forecast Mean of 4.5% and a Standard Deviation of 2%. Adding this contrast has the effect of raising the Result Mean for Short Term Bonds by 1.69%, but the other Treasurys (Intermediate and Long Term Bonds) are raised by 3.21% and 4.70%. The US Equities are negatively affected, due to the correlations between the assets, in all cases by over 1%.

Whereas the Components Worksheet shows the impact of adjusting the Forecast Mean for any forecast, the Effects Worksheet shows the impact of including or excluding the entire forecast.

This example serves as an excellent illustration that sometime Forecasts may have unintended ripple effects on other assets' result means.

Results Worksheet

The Results Worksheet displays the following:

- Asset names

- Asset descriptions (if enabled)

- Asset groups (if enabled)

- Start and end dates for the estimation window

- Historic means and standard deviations

- Forecast means and standard deviations

- If enabled, Contrast forecast asset coefficients, input means and standard deviations, historic means and standard deviations, and result means

- Result means, standard deviations, multiple correlations, and the full or partial correlation matrix.

- The Market Portfolio

Relevant Topics:

-

Saving explains your options for saving your data.

-

Reporting provides options for sharing your data.

-

Charts illustrate the numbers displayed on the Results Worksheet

Charts Worksheet

The Estimator contains several chart options to help you visualize and interpret the estimation results and to aid in reporting. All charts appear on the Charts Worksheet. Select the particular chart from the Chart Type drop down menu. For some of the charts, additional selections, such as particular assets, must be made.

Chart List

-

Asset Correlations

-

Asset Ranges

-

Assets Risk and Return

-

Growth of Asset(s)

-

Historical Returns

-

Rolling Correlations

-

Histogram

All pf the charts included in New Frontier's applications can be edited using Excel's chart editing tools. Typical edits might include adding legends, changing colors or line styles, switching axes, editing the title, legend, axis, or other labels, or adding annotations. Clicking on the chart will cause additional Excel ribbons to appear, which can be used to edit the chart. See an Excel manual for details.

Return Series

Return series consist of returns for a set of assets, expressed as percentages, at regularly spaced intervals over a period in time. The Estimator uses the raw data in the return series to estimate historical means, standard deviations, and correlations. Return series can be saved, loaded, imported from online sources, or entered directly into Excel either manually or through copy/paste.

Return Series Preparation

Return series appear on the Asset Returns Worksheet.

-

Use the File>>New>>New Return Series Option to access the New Return Series Wizard. Enter the characteristics of the new return series (below), then click the OK Button. A grid appears with the dates to the left and a column for each asset. A thick black line delineates the area to be completed. Each cell within the grid populates with "N/A", indicating that the cells can be edited.

-

Start and End Dates -- Enter the dates of the earliest and latest return observation, even if these vary between assets. The Estimator contains tools for adjusting the date range to fit your needs. Click on the triangles at the end of the date fields to access a calendar. You can add or remove dates later. Note that the Estimator cannot handle dates earlier than 1900.

-

Period -- Select year, month, quarter, week, or day depending on the frequency of the return observations. The maximum number of observation dates is 10436 for weeks, 2400 months, 800 quarters, or 200 years. For daily data, review the warning below.

-

Number of Assets -- Enter the number of assets that you wish to include in your return series. Add or remove columns later at your discretion. The maximum number of assets is 200.

-

-

Double check the dates to ensure that they match the dates on your return observations, repeating step one as necessary. Regular observations are essential. For instance, you cannot combine bimonthly and weekly observations.

-

Enter asset names, tickers, descriptions and groups as desired. If you do not want to use groups or descriptions, you can hide the row in the Display Menu.

-

Insert collected return observations in the appropriate columns. Copy return observations from other spreadsheets or old return series, use the Yahoo! returns importer, import from Bloomberg, or enter return observations manually. Commonly, users load an old return series and add the most recent return observations either by typing them in or copying them from a spreadsheet. For missing data, enter a letter not a zero; the cell populates with "N/A" in red. The Estimator is limited to 200 assets. The maximum number of observation dates is 10436 for weeks, 2400 months, 800 quarters, or 200 years.

-

If you wish to add an additional asset, enter the asset name and return observations in a column outside of the black box, and then click the Validate/Resize button in the Run Section of the NFA ribbon. Estimator resizes the edges of the return series according to row and column headings and redraws the thick black line that delineates the edges.

-

Remember that the Estimator is limited to 200 assets.

-

When you validate/resize, the Estimator converts your returns to percentages, so if you want the return to be 1%, enter 0.01.

-

Update the market portfolio and forecasts if relevant.

-

You can insert a column in the middle of the asset returns, but only one at a time. To insert multiple columns, enter the data outside of the box to the right.

-

-

To exclude an asset without deleting the data, use the checkmarks above the return series column. For details, see the Asset Returns Worksheet.

-

To delete an asset, delete the column. Highlight the column by clicking on the column letter; right click to call up the menu. Select the Delete option. The column disappears and the box resizes.

-

Be aware that there is no Undo function in any of the New Frontier applications, so deleted data cannot be recalled. Using the check box to remove the asset from the asset universe may be a better solution.

-

Update the market portfolio as necessary.

-

Due to formatting issues, you cannot delete the first column in the return series. Work around this restriction by copying data into other columns, or by using the Asset Selector to reorder assets.

-

Using the delete button on the keyboard instead of the delete option in the menu that appears when you right click, deletes the data but not the column.

-

You can delete multiple columns at the same time provided that they are contiguous. Non-contiguous columns cannot be deleted at the same time.

-

-

To delete a date, delete the row. Highlight the column; right click to call up the menu. Select the Delete Option. The row disappears. Be aware that there is no Undo function in any of the New Frontier applications, so deleted data cannot be recalled. The black box that borders the return series will be redrawn. Due to formatting issues, you cannot delete the first row in the return series. An alternate way to remove dates from the return series is to adjust the period on the Historical Worksheet.

-

If you wish to add an additional date, enter the date and return observations in a row outside of the black box, and then click the Validate/Resize Button in the NFA ribbon. Estimator resizes the edges of the return series based on row and column headings, and redraws the thick black line that delineates the edges.

-

Review the return series. Specifically review all cells that report missing data and the Dates Column.

-

Save your return series for further use.

-

Set a benchmark return series.

-

Start historical data adjustment.

Warnings:

-

When you add or delete rows, ensure that the dates have a consistent period. If you delete one month in the middle of a monthly return series or add a monthly observation to a quarterly series, the final return series will not be viable.

-

For daily data, remember that the Estimator ignores non-trading days as identified by not having a price for that day. It counts the remaining days and uses that number to calculate the annualized return. It does count the days for all assets together, so for the most accuracy, specify the prices for all days including holidays.

Importing Returns from Outside Sources

If you enter tickers in the Asset Tickers row of the Asset Returns Worksheet, the Estimator can import return data from Yahoo! Finance, the Bureau of Labor Statistics (BLS), Financial Modeling Prep (FMP), and Bloomberg. (See the Considerations section below for more information about the data sources.) To access these features, click on Load, and select the Import menu in the Estimator Ribbon.

The Import returns from online data sources option within the Load drop down menu on the NFA ribbon overwrites any data in the columns of recognized tickers.

The Update returns from Yahoo/BLS option only imports data to empty cells or cells that display "N/A". It will not disturb previously entered returns, which is useful for appending data to previously vetted returns.

The Update returns since Last Update option will limit the data import process to returns at the end of each asset return series, since the last update. This is useful for adding new time periods to update a dataset without disturbing previous work, which could include N/A entries that were deliberately created to eliminate undesirable data.

-

Open a saved case or set up a new return series matrix on the Asset Returns Worksheet.

-

Check that the correct tickers, date range, and period appear. (If not, either start a new return series or add the appropriate rows and columns.)

-

Set the desired data source for each asset in the Ticker Source Row. For instance, BLS for CPI, Yahoo for VGSIX, etc.

-

Enter or update asset names, descriptions, and groups as desired.

-

If new columns or rows have been added, run Validate/Resize before importing returns.

-

-

Ensure that your computer is connected to the internet.

-

Select the import or update option from the Import submenu of the Load drop down menu. The returns populate as available. Data that cannot be imported or updated appears as "N/A".

-

Since the data are streamed from online sources, sometimes data acquisition is erratic and may produce unexpected results. If this happens, try again and usually the problem will be resolved.

CPI

If you wish to use the Consumer Price Index from the Bureau of Labor Statistics as your benchmark return series, enter CPI in the Asset Name field in the Benchmark Column and the Series ID from the Bureau of Labor Statistics website in the Asset Ticker field. Select "BLS" as the Ticker Source. As there isn't just one Consumer Price Index, you will need to select the appropriate index for your data.

Sample Series IDs as of October 2011: (Use Excel's Paste Special--text option to copy into the Asset Returns Worksheet.)

- CUUR0000SA0 - U.S. All items, 1982-84=100

- CUUR0000SA0L1E - U.S. All Items Less Food and Energy

- CWUR0000SA0 Consumer Price Index - Urban Wage Earners and Clerical Workers

- CWUR0000SA0L1E - U.S. All Items Less Food and Energy, 1982-84=100

Considerations:

-

Importing CPI data is not available for daily or weekly return series.

-

The tool looks for the closest date available, so if you enter dates in the middle of the month, the data still will be the standard monthly return.

-

If the last day of the last period is in the future, data for that period will be partial, up to the most recent market close before the import. However, the date listed in the left column after the import will be the day representing the end of the period, not the end date of the imported return.

-

New Frontier does not check for importation errors or source data issues. New Frontier takes no responsibility for the accuracy of the data. We recommend that you check all imports carefully.

-

For Yahoo!, New Frontier pulls the Adjusted Close prices, which are adjusted for splits and dividends. Access Yahoo! directly to understand more and to check their terms of service.

-

For CPI data, access the Bureau of Labor Statistics.

-

-

You can import index returns by entering the index ticker preceded by a ^ as long as the index appears on Yahoo! Finance.

-

If the tool does not recognize a ticker while importing, any data in the column will be deleted.

-

If the tool does not recognize a ticker while updating, the column remains exactly the same.

-

Neither import nor update affects assets that have been removed from the case via the Asset Wizard.

Related Topics:

-

Asset Returns Worksheet

-

Return Series

-

NFA Ribbon

-

Benchmark Return Series

-

Bloomberg

Importing CSV Returns

You can import CSV files into the Estimator as asset return series or benchmark return series. Remember that CSV files are limited and demand more from the application, which can lead to errors. Please review imported CSV files carefully.

Preparing a CSV Return Series:

-

The first column heading in a CSV return series file should be "Date".

-

Use the asset name at the top of each asset column.

-

The date should be in MM/DD/YYYY format.

-

Returns should be in decimal notation, not percents. For example, the Estimator takes "1" as 100% and "0.5" as 50%.

-

Do not include asset descriptions.

Importing a CSV Return Series

-

Click on the Load Menu in the NFA ribbon.

-

Select the Import CSV Return Series option from the Import sub-menu. The Import ReturnSeries from CSV Window appears.

-

Navigate to the saved file.

-

Double click on the file, or click the Open button.

-

Several warnings may appear about assets with the same name or dates that don't match. You may need to adjust your file before trying again.

-

Review the data on the Returns Worksheet.

-

Ensure that the Estimator figured the period correctly.

See Saving Files for information on exporting return series as CSV files.

Bloomberg

The Estimator can import return data from Bloomberg if you have Bloomberg access.

Setup your Bloomberg access by entering account information.

- Access the Preferences Window by clicking on the Preferences button in the far left of the ribbon.

- Click on the Bloomberg option to access the Bloomberg Tab.

- Check the Enable Bloomberg Per Security Box.

- Enter your Bloomberg security information, contacting your IT department and Bloomberg as necessary.

- Click on the OK button. The information you entered remains saved in Preferences until you change it.

- If you have specific terminal information,

Import data

- Check that the desired assets, date range, and period appear. (If not, either start a new return series or add the appropriate rows and columns.) Click the Validate/Resize Button.

- Enter the appropriate BBGID Composites in the Asset Ticker row on the Asset Returns Worksheet.

- Ensure that your computer is connected to the internet.

- Either import or update data.

-

The Import returns from online sources option within the Load drop down menu on the ribbon overwrites any data in the columns of recognized tickers.

-

The Update returns from online sources option, also found within the Load drop down menu, only imports data to empty cells or cells that display "N/A". It will not disturb previously entered returns, which is useful for appending data to previously vetted returns.

-

Data that cannot be imported or updated appears as "N/A".

Financial Modeling Prep (FMP)

The Estimator can import return data from Financial Modeling Prep (FMP) if you have access.

Setup your FMP access by entering account information.

- Access the Preferences Window by clicking on the Preferences button in the far left of the ribbon.

- Click on the Misc Data Sources option.

- Enter your Financial Modeling Prep (FMP) API key, contacting your IT department and FMP as necessary.

- Click on the OK button. The information you entered remains saved in Preferences until you change it.

Import data

- Check that the desired assets, date range, and period appear. (If not, either start a new return series or add the appropriate rows and columns.) Click the Validate/Resize Button.

- Enter the appropriate Tickers in the Asset Ticker row on the Asset Returns Worksheet.

- Ensure that your computer is connected to the internet.

- Either import or update data.

-

The Import returns from online sources option within the Load drop down menu on the ribbon overwrites any data in the columns of recognized tickers.

-

The Update returns from online sources option, also found within the Load drop down menu, only imports data to empty cells or cells that display "N/A". It will not disturb previously entered returns, which is useful for appending data to previously vetted returns.

-

Data that cannot be imported or updated appears as "N/A".

Loading

Click on the Load button in the File Menu to access the Load Data File Window. Navigate to select the desired file. Click the Open button. The file populates depending on file type.

Estimator files (*.nfei)

Estimator files contain Estimator cases. All data entered to the Estimator when you saved the case populates when loaded.

Portfolio files (*.nfp)

A portfolio file stores the asset weights of a portfolio. Loading a portfolio into the Estimator replaces the market portfolio on the Historical Worksheet. Any assets in the portfolio that are not present in the active case are discarded, so use caution if there is a different investment universe in the saved file since the weights of the portfolio may sum to a different total than expected.

Return Series Files (*.nfrs)

Return Series files contain up to 3000 return observations and corresponding dates. The Estimator can load return series prepared on the Asset Returns Worksheet. Alternately, you can import return series in CSV format or import returns from online sources.

-

If the file contains a single asset's return series with the same dates as the other series, the return series replaces the benchmark, which appears on the Asset Returns Worksheet. The active case remains unchanged.

-

If the file contains multiple assets' return series, the return series in the file replace the active case. The first series in the file automatically is set as the benchmark return series.

Risk Return Set Files (*.nfrrs)

A risk-return set contains expected returns and standard deviations for a given set of assets, plus a full correlation matrix spanning the set. Loading one into an Estimator session replaces the data on the Forecasts Worksheet. Assets that are not included in the active case are discarded. Though the Estimator can save any of its three risk-return sets (historical, forecasts, or results), and you can load any of the three into the Optimizer, the Estimator loads all risk-return sets as forecasts.

Benchmarks Return Series

A benchmark return series is a series of returns for a single or a composite asset. The benchmark return series can be used for adjusting the historic return series by a standard. This is an optional input, but if you use it, the benchmark return series acts as a baseline for measuring asset performance. You must decide what to use. Inflation and risk free assets are popular benchmarks, which is why the Estimator can import the Consumer Price Index from the Bureau of Labor Statistics as a benchmark. Pension funds have been known to use their liability stream. Using treasury bill returns is one way to achieve a risk free return series.

-

The currently selected benchmark return series appears in light blue to the left of the Asset Returns Worksheet and in the Benchmark drop down menu in the Series Adjustment section of the ribbon.

-

The benchmark return series only affects the estimation if it is included as an asset or if you have selected a series adjustment option. It can appear on the Asset Returns Worksheet without changing anything.

-

Change the currently selected benchmark in the Benchmark drop down menu in the Series Adjustment section of the ribbon.

-

You can prepare a benchmark return series on the Asset Returns Worksheet as one of the assets. Alternately, you can load or import a benchmark return series as a *.nfrs or *.csv file. The benchmark can be either a single asset file, loaded separately, or one of many assets in a return series file.

-

-

The dates and period type of the benchmark return series must match those of the asset return series used in the case.

-

Unlike regular asset return series, a benchmark return series must be complete. There can be no missing data.

-

The Estimator assumes that you intend to load a benchmark return series when you load or import the return series for a single asset.

-

-

You can choose whether or not to include the benchmark return series as an asset. For example, if you load the Consumer Price Index as your benchmark, you may not want to include it in your asset universe as an asset.

-

-

If the benchmark return series is included as an asset, it will appear twice on the Asset Returns Worksheet, once to the left in light blue and once in the regular blue.

-

Remove or return it to the asset universe by checking or unchecking the box above the return series on the Asset Returns Worksheet.

-

If you do include the benchmark return series as an asset, the Estimator ignores the entered market portfolio in favor of a market portfolio that is 100% the benchmark return series.

-

-

You can also derive a new benchmark return series based on the asset weights defined in the market portfolio.

-

-

The return for each period is a weighted average of the returns for each selected asset class, where the weights are given by the market portfolio. (Therefore, deriving a benchmark only works when you have complete data; missing data results in a benchmark return series with missing data.)

-

To derive, select the Derive Benchmark option at the bottom of the assets listed in the Benchmark drop down menu in the ribbon. The new derived return series is added to the universe of assets and overwrites the previous benchmark return series on the Asset Returns Worksheet.

-

If you change the market portfolio or the returns, the derived benchmark automatically updates.

-

Assets Wizard

The Assets Wizard provides functionality to select return series subsets and sort assets in the Estimator. Access the Assets Wizard by clicking the Assets button in the NFA ribbon.

Exclude/include an asset from the estimation by removing the checkmark from the row of boxes.

-

This duplicates the functionality of the checkmarks at the top of the columns on the Asset Returns Worksheet.

-

Unchecked assets remain hidden in the saved case, but will not be included in the Estimator's calculations.

-

Excluded assets are not affected by importing or updating returns from outside sources.

-

If you do exclude/include an asset's return series, it may be necessary to change the market portfolio weights.

-

Saving a case in Excel format removes any excluded assets permanently, which is one of the reasons that is not recommended to save cases in that format. Saving a case in NFA format keeps excluded assets in the Wizard so they can be returned to the investment universe at a later date.

Sort the assets by clicking on the column headings. For example, clicking on the Asset Name heading sorts the assets by name. This duplicates the sorting functionality found on the worksheets (double clicking on the Asset Name heading on the Historical Worksheet will also sort assets by name.) The difference is that here you can select an asset row and use the Move Up and Move Down Buttons to customize the sort. You can also save a particular sort by clicking on the Store Order Button. Clicking on the Restore Order Button at a later point will sort the assets according to that previous sort.

Forecasts

Forecasts reflect assumptions about assets' return distributions, derived from other sources than your historical data. They may come from current data, i. e. yield information for bonds, or from more generally held principles of finance. The forecasts described on this page are generally single-asset forecasts. For forecasts relating multiple assets to each other, use forecast contrasts. Forecasts must include return and risk projections, but correlations are optional. Alternately, a previously saved risk-return set can be loaded to the Forecasts Worksheet.

Forecasts are combined with the historical data analysis when the Run Bayes button in the Estimator ribbon is clicked. The result combines the two signals with relative strengths determined by the standard deviations and correlations. Larger standard deviations indicate less certainty, and thus less strong of an influence in the result. Ignoring correlations for the moment, a forecast with an equal standard deviation to the historical standard deviation will produce a result mean (expected return) halfway between the historical return and the forecast return for that asset.

-

Forecast means are your estimates for how a particular asset class will perform in the next year.

-

The standard deviation of forecast is a subjective estimate of the uncertainty of the user's return forecast, indicating the strength of the forecast. If you are uncertain about a particular return estimate, enter a high percentage, maybe even as high as 50%. The standard deviation dictates whether the return observations or your forecasts dominate the results.

-

-

One rule of thumb is to think of the forecast return as x% +/- y, where x is the return and y is the standard deviation. Therefore, a forecast return of 10% with a standard deviation of 5% implies a forecast range of 5-15%, while a standard deviation of 20% implies a forecast range of -10% to 30%. A 5% standard deviation indicates a more precise forecast and has more influence on the final result.

-

The historic mean and standard deviation appear for reference. Another rule of thumb to consider is that if the standard deviation of the forecast is a smaller number than the historic standard deviation, the result will be closer to the forecast since its certainty is greater.

-

Standard deviations must always be positive.

-

Entering zero, a negative value, or a non-numerical value for the standard deviation causes the cell to be replaced with the text “N/A". Depending on what is selected in the Bayes Forecasting drop down menu, a "N/A" in the Std Dev of Forecast column causes an error (Forecasts), nothing (Historic), or for the specific asset to be unaffected by running Bayes estimation. Note that turning the prior off for an asset is not the same as increasing the standard deviation to a very large number, because in the latter case the mean estimates will still be influenced by the correlations. Turning the Bayesian functionality off for an asset has the additional property of setting all (forecast) correlations for that asset to zero.

-

The Result Mean Column only populates after running Bayes. This column appears for your reference as you adjust forecasts.

-

-

Select the source of the correlation matrix used during estimation from the Forecast Correlations drop down menu.

-

-

You may have little reliable forecast information on the correlation of assets in the future. In that case, select the Use Historic Option to use the historic correlations. The correlations on the Forecasts Worksheet remain grayed out to indicate that the matrix on the Historical Worksheet will be used. This is generally recommended.

-

Selecting the Use Forecast Option causes a blank correlation matrix to appear. Complete the matrix with your correlation projections. Alternately, copy the historic correlations to the Forecasts Worksheet using Excel copy and paste. Use caution in manually creating forecast matrices as it is easy to create matrices that are not positive definite, i. e. are not allowable correlation matrices.

-

-

A more flexible and advanced tool for entering relative information comparing or combining multiple assets is forecast contrasts. Choose whether or not to display contrast fields in the Display Menu.

-

To combine forecasts with the historical analysis in the results, click the Run Bayes button.

The input forecasts are used according to your further selections on the Forecasts Worksheet.

Forecast Contrasts

Displaying Forecast Contrasts

Display of forecast contrasts is toggled through the Display Menu. When displayed, forecast contrast entry fields and intermediate result tables appear on the Forecasts Worksheet as well as on the Results Worksheet. When forecast contrasts are hidden, they are disabled and do not impact the Estimator case.

You enter up to 50 contrasts. Individual contrasts can be turned on or off by checking or unchecking the boxes on top of the column. Contrasts are also considered off if they have no standard deviation or weights. When they are on, they appear in a darker blue font. When they are off, they appear in lighter blue font.

The tops of the columns indicate how the contrast has been weighted. If a contrast is weighted according to the market portfolio, the top of the column states "Market Weighted". Similarly, the Estimator labels contrasts with equally weighted groups of assets as "Equal". If either of these labels appears, the contrast's weights will update automatically if the case changes (market portfolio changes, added asset, etc.). If no label appears, the contrast has been weighted manually and it will not update automatically.

The Vanguard sample cases include sample contrasts to explore.

What Are Forecast Contrasts?

Forecast contrasts are forecasts for groups of assets that are applied to your assets along with any entered single asset forecasts when the Run Bayes button in the Estimator Ribbon is clicked.

Forecast Contrasts provide a way to include investor views in an estimation process. These investor views are merged with historical information as well as any other forecast information to form the final estimates, which balance all information sources to give final estimates. Contrasts may be familiar to practitioners through the Black-Litterman procedure, and NFA’s implementation of contrast forecasts is entirely analogous to the “investor views” in that procedure.

When a view target (mean) differs from its corresponding historical prediction, a contrast will bend the estimator results towards that target. The strength of the view’s influence on the answer can be adjusted through the contrast standard deviation. Thus a vague view which is not tightly focused is assigned a large standard deviation and has a less pronounced effect on final estimates than a specifically focused, high-certainty view, which has a small standard deviation.

A complete specification of a contrast includes a portfolio (which may sum to 0% or 100%), a mean (target for the expected return of that portfolio), and a standard deviation, which controls the influence of the view on the result. Larger standard deviations signify less focus and less influence on the result.

Although contrast portfolios may legally sum to any number, it is fully general and simpler to consider only contrast portfolios that sum to zero or 100%, since contrast portfolios summing to any other number can be converted into another equivalent contrast with a portfolio summing to 100% by dividing portfolio, mean, and standard deviation by that sum.

Sum-to-zero contrasts are useful for comparing one asset, or basket of assets, to another single asset or basket. The portfolio weights can be broken into one sum-to-100% portfolio minus another. The contrast mean then represents the expected difference in returns, or expected premium of the positive portfolio over the negative one. The standard deviation controls the influence on the results.

Sum-to-100% contrasts are views on portfolios. A suitably weighted basket of assets is assigned an expected return and standard deviation.

Example: Global Market Forecast (Portfolio view: sum-to-100% contrast)

A manager might have information about which way the total market is headed, above and beyond what history tells us. A market-capitalization weighted portfolio would be assigned a target, e. g. somewhat more positive than the historical forecast, if a particularly good quarter is expected for the entire market. Standard deviation could be assigned to be equal to the historical estimate for the market portfolio, to influence the result roughly equally to history. If historical estimates are present, the NFA software displays the historical mean and standard deviation of the contrast portfolio, once entered, for reference.

Example: Risk Premium (Group difference view: sum-to-zero contrast)

A manager likely has personal outlooks on various risk premia. Risk factors have been an important subject of study for estimation in finance. To specify a particular risk premium, a basket would be chosen to represent those assets possessing the risk factor, and another basket representing assets without the factor. For example, for the size premium, baskets of small-cap equities and large cap equities can be created. The small assets would be assigned the positive weights of their basket, and the large assets would be assigned negative weights. The mean would target the actual target premium, and the standard deviation would be assigned relative to the historical standard deviation. The estimator results would then show a size premium (expected return of the contrast portfolio) pulled toward the contrast mean.

Entering Forecast Contrasts Manually

When forecast contrasts are displayed, one forecast contrast entry column appears on the Forecasts Worksheet.

-

Enter a name for the contrast in the column heading.

-

Enter a percentage for each asset to be included in the contrast. The percentage reflects the asset's weight in the group.

-

-

Positive, negative, or zero values are allowed.

-

Contrasts with all zero weights will be eliminated from the estimation procedure.

-

-

Enter your forecast for the group of assets in the Mean and Standard Deviation Fields.

-

-

These two entries are analogous to the Forecast Mean and Standard Deviation of Forecast columns for Bayes Forecasting. In fact, with 100% in an asset’s row and 0% in all other assets, any mean and standard deviation entered here is equivalent to entering the mean and standard deviation Forecast Mean and Standard Deviation of Forecast columns for that asset.

-

All values are legal for the mean and positive values are legal for the standard deviation.

-

-

To enter additional forecast contrasts, click the “+” button and repeat the steps above, or use the Contrasts Wizard (see below).

-

To delete the rightmost forecast contrast, click the “-” button. To delete other contrasts, without deleting the rightmost contrast, access the Contrasts Wizard (see below).

-

To turn a contrast off, enter a zero, a negative number, or a non-numerical entry in the Standard Deviation Field. "N/A" appears in the field, and the column turns a lighter blue. Contrasts that are off are not included during estimation.

-

When NFA Bayes or Forecasts is selected in the Bayes Forecasting drop down menu, click the Run Bayes button in the ribbon in order to combine all forecasts with the historical results. The results will appear on the Results Worksheet.

-

The historical numbers are presented below each contrast on the worksheet for guidance as to how to set the forecast mean and standard deviation.

-

-

Historic Mean indicates the historical return for the portfolio with the same weights as the contrasts for comparison purposes. For instance, if you entered a contrast with 100% in Euro Bonds, this field would show the historic return of Euro Bonds.

-

Historic Standard Deviation indicates the historical standard deviation for the contrasts. For instance, if you entered a contrast with 100% in Euro Bonds, this field would show the historic standard deviation of Euro Bonds.

-

Result Mean shows the final result of expected return for the contrast, including historical estimates, single asset forecasts, and contrasts.

-

Contrast Effect shows the difference in estimates with and without that contrast, the estimate with all contrasts minus the estimate with all contrasts except the one in question.

-

Equity Premium Example

One way to forecast an equity premium, where the bond weights sum to -100% and the equity weights sum to 100%, is to equally weight the bonds and weight the equities in proportion to their market weights. Using this method, the contrast portfolio for the default sample case would be:

-

Euro Bonds: -50%

-

US Bonds: -50%

-

Canada: 5%

-

France: 10%

-

Germany: 10%

-

Japan: 30%

-

UK: 10%

-

US: 35%

If you believe that the equity premium will be 8%, enter 8% as the mean. The historic mean for this portfolio is shown as 5.9% and the historic standard deviation is 13.7%. So, entering 8% as the standard deviation would represent a view which is relatively strong when compared to the historical information only. Indeed, with these settings the result mean is 7.5% and the contrast effect is 1.5%, moving the result mean from 6.0% to 7.5%.

The Vanguard data sample cases provide additional examples of forecast contrasts.

Contrasts Wizard

Click the Edit Contrast button on the ribbon. The Edit Contrasts Window appears. If you want to enter a view (forecast) on a single portfolio, click the Add Portfolio Forecast button. A dialog window the opens with the complete list of available assets in the left pane. Use the Add and Remove buttons to move the desired assets into the Selected Assets Box. Select either the Equal Weight or the Market Weight option. Fields then must be entered for the Mean (target value) and Standard Deviation (dispersion) for the contrast. For reference the historical mean and standard deviation of the chosen contrast are displayed. A name for the contrast can be added in the top field. Click the OK button. The contrast weight for the ith asset is then proportional to the market weight. In mathematical terms this is equal to (1iwi)/(Σj1jwj) where

-

1i={1 if the asset is in the contrast, 0 otherwise

-

wi={1 if equal weighting is selected and the ith market weight if market weighting is selected and the summation in the denominator is over the entire asset set.

A view (forecast) contrasting two portfolios can be entered by clicking on the Add Contrast Forecast button. A dialog appears with the list of available assets at the top center. Add assets to a group by using the appropriate Add button. At least one asset must be on each side. Select either the Equal Weight or the Market Weight option. Complete Forecast Mean (target value) and Forecast Standard Deviation (dispersion) Fields. Watch the sign of the forecast mean. The return of group A is forecast to exceed the return of group by the forecast mean. For reference the historical mean and standard deviation of the chosen contrast are displayed. A name for the contrast can be added in the top field. Click the OK button. The contrast weight for the ith asset is then proportional to the market weight within its portfolio. This is mathematically equal to (signiwi)/(Σj1sign j = sign iwj) where

-

signi={1 for the positive assets, 0 for assets not included in the contrast, and -1 for negative assets

-

1sign j = sign i = {1 if signj = sign i, 0 otherwise

-

wi={1 if equal weighting is selected, the ith market weight if market weighting is selected and the summation in the denominator is over the entire asset set.

Maintaining Contrasts

-

You can edit contrasts manually at any time, by making changes directly on the Forecasts Worksheet. Alternately, access the Contrasts Wizard, select a contrast, and click the Edit Button. If the Estimator recognizes the contrast type, either the Portfolio Forecast or Contrast Forecast Window will appear with the current contrast data. Make the desired changes. Click the OK button.

-

Market portfolio weighted and equally weighted contrasts automatically update when the market portfolio changes or the number of assets in the case changes. (Note that if you load an older case, the source of the weightings may not appear above the contrast. In those situations, you will need to update the contrast manually.) The "market-weighted" or "equal" indicator at the top of the column tells you whether or not the contrast will update automatically.

-

Managed contrasts, marked with either "equal" or "market-weighted", must be edited with the wizard in order to maintain their managed, automatically-updating status. If you change the weights manually, the contrast will no longer update automatically.

-

To delete a contrast,access the Contrasts Wizard, select a contrast, and click the Remove Button.

-

Rather than delete contrasts, some users prefer to deactivate the contrast so that it will be available later. To do so, remove the checkmark from the box above. The contrast will appear in a lighter blue to indicate that it is inactive. To reactivate, re-check.

Market Portfolio

Purpose

The market portfolio acts as the reasonable prior referenced by the Estimator for several historic data adjustment methods, can be used to calculate forecast contrasts, and can be used to derive a benchmark return series.

Weighting

Depending on what the market portfolio will be used for, you may want to equal weight the market portfolio, enter capitalization weights, or weight the assets according to another criterion. By default, the Estimator sets an equal weighted market portfolio.

If you enter a specific weight for an asset, that weight shows on a white background. The Estimator automatically equal weights the remaining assets in the portfolio, which show on a blue background, and leaves those you entered alone. For you adjust the asset universe frequently, this removes the need to adjust the market portfolio every time as long as you’re content to have all or part of your market portfolio equally weighted.

Mechanics

- The market portfolio appears on the Historical Worksheet.

- If you delete your market portfolio, an equal weighted portfolio will appear.

- Loading an NFA portfolio file (*.nfp), provided that the assets match, will fill in the market portfolio.

- Changing the asset universe may necessitate changes to the market portfolio and to any contrasts that rely on the market portfolio depending on how you have set up the case.

-

The market portfolio appears on the Results Worksheet to facilitate review of inputs and results on one page.

Period

When you load a return series file or previous Estimator case, the Period Table on the Historical Worksheet populates according to the dates contained in the file. The Period field beneath the columns displays the number of possible observations, missing or observed, in the period used by the return series. Whether the frequency of the historical dataset is daily, monthly, quarterly, or annual, the Estimator produces annual estimates by annualizing return series according to a standard approximation: monthly returns multiplied by 12 and standard deviations multiplied by the square root of 12. Other frequencies are handled similarly.

Drop down menus beneath the From and To column headings on the Historical Worksheet display the beginning and ending dates for the estimation problem. These columns populate automatically with the first date that appears in each asset's return series. When return series start on different dates, the Period Field calculates from the oldest return observation, and the more recent dates appear in red. Similarly, when return series end on different dates, the Period Field calculates to the most recent observation, and the older dates appear in red. The Missing Data field on the Results Worksheet reads "Missing Data" when any missing data appears within the date range specified in the From and To columns.

Table 1 Table 2

In Table 1, several of the assets have returns stretching back to January of 1978. The red dates indicate the earliest return observation for the remaining assets. The Estimator calculates the period from January of 1978. As you change the date in the From drop down menu, the dates and period change to reflect the newly selected date. Table 2 shows the same assets, but with the From date adjusted to June of 1979. Now all but one of the assets have observations, and the period is reduced to 199 months.

Longer return series provide more statistical reliability, as long as the entire period is relevant to the intended investment period for the model portfolios to be generated by the Optimizer. Ideally, include several investment cycles for each asset. Bear in mind that though the Missing Data Algorithm produces estimates in the presence of missing observations, its accuracy diminishes with larger percentages of incomplete data, particularly when the data is in sequence. Examine your data to determine what period adjustments meet your needs and make sure there is enough relevant information in the dataset to produce adequately precise estimates.

Related Topics:

-

Running an Estimation Problem

-

Missing Data Algorithm

-

Return Series Files

-

Historical Worksheet

-

Results Worksheet

Series Adjustment Value

The Series Adjustment Value is a constant that can be used during Historic Data Adjustment. The Value Field activates when the Benchmark Average or Adjust by Fixed Constant options are selected from the Series Adjustment drop down menu in the ribbon. (The Benchmark Relative Option doesn't require a Series Adjustment Value.)

-

When the Benchmark Average option is selected, the Series Adjustment Value represents the user's estimate of current benchmark return. Often this is the risk free rate. The Series Adjustment Value is assumed to be annualized.

-

When the Adjust by Fixed Constant option is selected, the Series Adjustment Value represents the fixed amount used to adjust the mean of the historic asset values.

Risk Scaling Factor

The Risk scaling factor is turned off by default and can be enabled in the Display Menu. When first enabled, it shows a factor of 1.0 for each asset's standard deviation, meaning that no adjustments have been made to the result standard deviations.

Changing the value of a risk scaling factor means that the result Standard Deviation for the corresponding asset will be scaled according to the factor provided. This feature is provided as a convenience to include cases where an asset's standard deviation uses a different method to estimate its risk.

Normally it is not recommended to adjust the values of the risk scaling factor or the result standard deviations.

Asset Groups

Assets in the Estimator and Optimizer can be assigned to groups, such as stocks and bonds.

Display Groups

To display or hide fields pertaining to groups, select Asset Groupings in the Display Menu.

Assign and Add Groups

Assign groups on the Asset Returns Worksheet. Add a new group by typing the name in one of the cells of the Asset Group row. Once a group has been added to the list, you can select the appropriate group for each asset from the drop down menu. For instance, in the default sample case, the assets are assigned as either a stock or a bond. Those two options appear in the drop down menu when a cell in the Asset Groups row of the Asset Returns Worksheet is selected. You can select either of those, or you could type in a third group name instead, which would make that group appear in the drop down menu.

Using Groups